The titanium market is currently experiencing a significant structural divergence, characterized by high-end products leading the price surge while low-end products face downward pressure. This week, the domestic titanium market continued to exhibit price differentiation. High-end titanium products, supported by military and aerospace orders, saw prices rise against the trend, whereas low-end civilian products remained sluggish due to weak domestic demand and foreign trade pressures, highlighting the industry's structural contradictions.

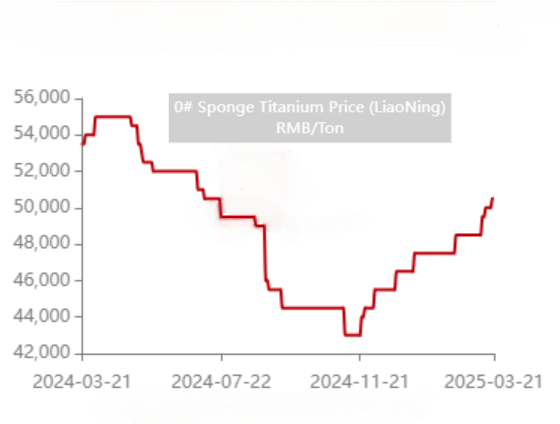

Sponge titanium prices remained high, with 0# and 1# grades holding steady at 48,000-49,000 yuan/ton and 47,000-48,000 yuan/ton, respectively. However, downstream procurement was mainly driven by rigid demand, resulting in subdued transactions. Titanium ingot costs provided strong support, with pure titanium ingot (TA1) and TC4 titanium ingot prices stable at 57-58 yuan/kg and 63-65 yuan/kg, respectively. Nevertheless, small and medium-sized enterprises in the civilian sector still faced pressure to sell at low prices.

Domestic orders in traditional sectors (chemicals, marine engineering) decreased by 15%-20% year-on-year, as new project investments slowed, suppressing demand. On the foreign trade front, the U.S. imposed a 10% tariff on Chinese titanium products, squeezing export profits. Coupled with China's tightening export policies on aviation-grade titanium, companies faced limited overseas expansion opportunities.

Leading companies maintained high capacity utilization rates thanks to high-end orders, with the top five companies (CR5) accounting for 57% of the market. Technological barriers are shifting competition toward R&D capabilities. The global aerospace supply chain is undergoing accelerated adjustments due to the Russia-Ukraine conflict, with Chinese companies seizing market gaps in Europe and the U.S. However, oversupply in upstream sponge titanium has put pressure on profit margins.

Industry experts predict that high-end titanium prices will remain stable or rise slightly, driven by military and aerospace demand, while low-end products may continue to experience weak fluctuations. Companies are advised to accelerate their transition into high-end sectors such as aerospace and shipbuilding, explore markets under the "Belt and Road" initiative to mitigate tariff risks, and optimize inventory management to avoid destructive competition.

The titanium market is at a critical juncture of transformation and upgrading, where technological innovation and market diversification will be the core paths for companies to break through.